Business closures happen for different reasons — but no matter what caused the business to close, it’s important to understand that you can’t simply stop operating.

As a business owner or self-employed individual running a freelance business, it’s your duty to perform the due diligence required to properly close the business. Your business registration needs to be officially recognized as void, otherwise, you risk facing serious legal and tax consequences.

This article is a guide on how to close a business in the Philippines. You’ll learn about the most important elements that make up a proper closure of business. It Includes the steps, time frame, and procedures to ensure a trouble-free closure of business.

Note: If you hired an accountant to file your taxes, it is best to consult with them first for guidance.

Contents hideA business closure is the result of a company or organization shutting down or ceasing to operate. It’s also sometimes referred to as “retiring a business”.

It essentially terminates the legal existence of the business by informing a few key government agencies and local units by submitting all required documentation (and paying all applicable fees) By doing so, you can free the business from any further tax obligations.

As the registered owner, if you fail to close your business properly, you could face a number of legal issues and tax liabilities.

As mentioned earlier, you can’t simply stop operating. If your business is still registered, your business is still operational in the eyes of the law.

When closing down your company, consulting services can prove helpful, but entrepreneurs need to be aware of things they should and should not do.

This includes properly informing both employees and suppliers/partners about their intentions so that any outstanding dues can be settled and other obligations fulfilled before the company is deemed as officially closed.

Here are the possible penalties for failing to close a business:

In the Philippines, the complete process can take anywhere from a few months to a year, possibly even more, depending on the situation.

If you have any outstanding issues (missed BIR filings, for example), expect it to take more time simply because the government needs to review and settle them all before your business can be officially recognized as non-operational.

If you’re closing down your business in the Philippines, you’ll need to provide notice of closure and termination to employees. You should notify DOLE at least 30 days prior to the planned date of closure. In addition, you’ll need to provide separation pay to your employees.

Before you proceed with the steps, it’s important to note that the actual process may vary depending on the type of business classification you have.

For freelancers, self-employed individuals, freelance business owners, and similar groups, the Department of Trade and Industry (DTI) needs to be notified of your decision to cancel.

For businesses, organizations, and cooperatives, the Securities and Exchange Commission (SEC) must be notified of your cancellation of business.

There are several steps required to start the process of business closure in the Philippines. Here’s a bird’s eye view of the steps for each corresponding regulatory agency/government unit. Note that you may or may not need to visit each entity, that depends on the type of business you have (as explained in the previous section).

Before you visit the barangay, make sure to bring all the requirements mentioned below along with some money to pay for any fees.

List of Requirements for business closure at the barangay:

Go to the Barangay hall to request a Barangay Certificate bearing the exact effective date of closure. You must submit a Letter of Request for Retirement in order to obtain the retirement certificate. In addition, you will be provided with a Barangay Clearance / Certificate of Closure.

Sample letter of Request for Termination of Business

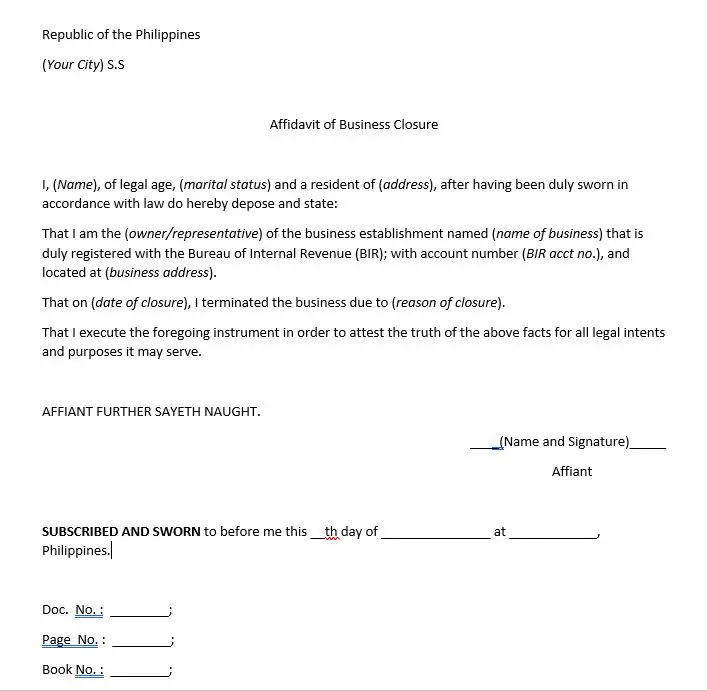

One of the first documents that you’ll be asked to provide in requesting for a cessation of your business is an Affidavit of Business Closure. To give you an idea of what it looks like and what it contains, here’s a sample:

Business owners who want to avoid getting assessed further taxes while their business is closed must file for Closure of Business and Cancellation of TIN with the Bureau of Internal Revenue (BIR). All business notices and corresponding permits need to be surrendered. You might also be required to submit an affidavit of loss if the business name certificate or a copy of the original application form was lost.

Note: Steps may vary depending on your business location. The following are the steps to close a business in Quezon City (QC LGU).

For businesses established in Quezon City, the City Treasury Department – Examination Division must be contacted to declare a business closed.

Steps for Closure at the City Hall

According to the BIR, “taxpayers who filed for cancellation of registration due to closure/cessation of business or termination of business shall be subjected to immediate investigation by the BIR office concerned to determine the taxpayer’s liabilities”.

1. Visit the nearest BIR office to apply for Closure of Business and Cancellation of TIN along with the following list of requirements and/or documents:

If your business type is a partnership or a corporation, the last step is to submit your intent to stop your business operation.

Business closure requirements of DTI for Sole Proprietors:

Business Closure Requirements of DTI for Partnerships and Corporations